News Blog

Market Analysis: Berlin real estate market still attractive

The German capital is still a popular investment location for international investors despite rising purchase prices. This is shown by the current real estate price service of the Real Estate Association IVD Berlin-Brandenburg which is based exclusively on actual rental and purchase prices. Thus, the prices for condominiums in the standard positions rose by 13.5% in the current year. For new buildings, the jump in price is 12.5%. The average rent for standard apartments climbed by 6.7% to 8 euros per square meter.

According to the IVD, this is due to an intensified dynamic in the lower price segments as well as higher property prices. Despite this, according to IVD Immobilienpreisservice (Real Estate Price Service), Berlin remains a market with a lot of development potential, especially since the prices in the federal capital are still following the level of other capital cities.

If you want to benefit from the Berlin real estate market, you can invest in the current CALVIN BERLIN project in the popular district of Berlin Mitte. You will benefit from 5% interest with a term of 12 months. Read more about the location and the project.

Risk Comparison of Current Real Estate Crowdfunding Projects

Evaluation of each project’s debt ratio helps to properly assess the overall risk of real estate project. The debt ratio is a obligatory information in the asset information sheet and reflects the ratio of debt capital to equity.

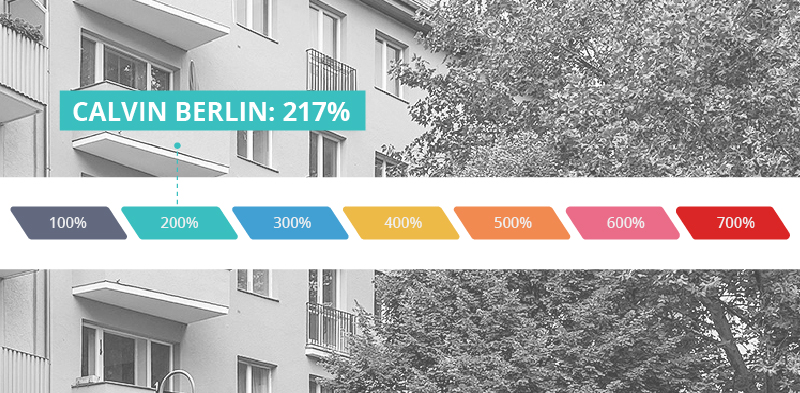

In a comparison of the debt ratios of 7 ongoing real estate crowdfunding projects on Wallstreet: Online our current project CALVIN BERLIN records the lowest rate.

The debt ratio is just 217%, which is up to three times lower than the other projects. Some projects have 700% debt and more. At first glance, the debt ratios are very high, but a debt ratio of 200% is very good in the real estate sector. For classification: A family that buys a family home for 300,000 euros and thereby contributes 20% equity is with a debt ratio of 500%.

In the current project CALVIN BERLIN you get 5% interest p.a. with a short term of only 12 months.