Real estate holdings – The ultimate guide for anyone planning to invest in real estate

A real estate holding can be a profitable investment if you know what to look out for. When you have finished reading this article you will be able to answer the following questions:

- What is important when investing in real estate?

- How do I assess the risks associated with real estate projects?

- What kinds of real estate holdings are there?

- What are the advantages and disadvantages of the specific types of investment?

Location analysis – The foundation of successful real estate holdings

Every real estate expert can tell you the three success factors for a real estate investment – location, location, location. Since it is impossible to change a property’s location, this location must be analysed before any investment is made. When doing so, the first aspect to be examined and determined is the macro-location – the city in which the real estate holding should be located. This decision is based on a comparison of facts and figures such as forecasts relating to population and household development in coming years. The objective of the subsequent micro-location analysis is to find out which area of the city selected has the most potential; how good transport links are and what amenities (such as doctors, shops, schools and cultural facilities) are on offer.

Depending on the type of real estate holding the investor must either carry out this important location analysis himself or rely on the judgement of a fund manager. In the case of real estate crowdfunding or closed-end real estate funds the investor chooses specific projects and thus automatically selects a certain location. The managers of open-ended real estate funds and real estate shareholdings purchase many properties. In these cases, the managers not the investors are thus responsible for analysing locations.

How to assess the risks associated with real estate holdings

There are a number of indicators which can be used to assess the level of risk associated with a real estate holding. The most important is the location and thus the location analysis which was discussed above.

There are, however, also risk indicators which relate to the specific property in question. An important factor in this regard is the ratio of outside capital to total capital. If the majority of the purchase price paid to acquire the property is financed by means of a bank loan, then the risk will be higher than if the property is purchased entirely from the buyer’s own funds. Where the outside capital ratio is high, an increase in interest rates can result in rental income no longer being sufficient to cover the monthly mortgage repayments to the bank.

A further criterion is the level of occupancy. It goes without saying that a property which has a high occupancy level will generate a corresponding rental income. The number of tenants is also important when assessing the risks associated with a real estate holding. If, for example, the total rental income is generated by just one tenant, then the risk of default is, logically, much higher than if there are five tenants. Multiple occupancy properties with many tenants thus represent a far lower risk than an office building with just one to three tenants.

Real estate holdings – How to invest in property

One real estate holding is not the same as the next. There are various ways to acquire holdings in properties. The following section discusses a number of types of real estate holding together with the associated opportunities and risks:

- Real estate crowdfunding

- Open-end real estate funds

- Closed-end real estate funds

- Real estate shareholdings

Real estate crowdfunding

The newest form of real estate holding for private investors is real estate crowdfunding. During a subscription phase which generally lasts three months, funds for a specific real estate project are gathered from private and institutional investors. Each investor in the crowd gives the issuer a microloan, receiving a pre-agreed rate of interest in return. As a general rule such loans are subordinate. In other words, if the real estate project runs into difficulties and becomes subject to a forced sale, then any financing banks will be the first to receive compensation, followed by the crowd investors. As a result, investment in this form of real estate holding can entail the risk of a total loss.

Real estate crowdfunding is booming

Real estate holdings via crowdfunding are becoming increasingly popular, also in Germany. The first crowdfunding platforms to offer real estate projects to their investors did so back in 2012. In this period, they gathered 1.5 million euros from the crowd for projects. Two years later the total sum had increased to almost 10 million euros and in 2015 had reached the sum of 18.4 million euros. The volume of crowd investment in real estate projects has thus increased by over 12 times since 2012.

Advantages of real estate crowdfunding

- Fixed rate of interest, usually between 4% and 8%

- No investor fees

- Low minimum investment sum possible

Disadvantages of real estate crowdfunding

- Risk of a total loss

Current investment opportunities

|

Open-end real estate funds

Open-end real estate funds are open-end investment funds which allow investors to invest small sums in real estate properties. This form of investment has become increasingly popular since the 1960’s. The industry experienced its first setback during the 2004 real estate crisis, when the German office real estate market in particular was subject to negative development. The first fund to run into difficulty was the Deka Immobilienfonds, after investors had withdrawn major sums of money over the course of several months, and the fund was only able to maintain operations thanks to rescue measures on the part of the German Association of Savings Banks (Deutscher Sparkassen- und Giroverband). One year later, a Deutsche Bank real estate fund had to be closed because too many investors had withdrawn their capital following concerns about value adjustments.

Up to 70% of investor funds lost

Following a short period of recovery, the financial crash caused investors to finally lose their faith in open-end real estate funds. During the financial crash institutional investors required funds and withdrew large sums of money from the funds within a very short period of time. In response to this, in early 2009 a number of funds suspended repurchase of shares for periods of up to twelve months. As a result, some funds even had to be wound up, in the final accounting losing up to 60% to 70% of investor funds.

New regulation by the German Capital Investment Act (KAGB)

Legislators reacted to the open-end real estate fund crisis by passing the German Capital Investment Act (KAGB) in 2013. The Act specifies that investors must leave their capital in funds for at least two years. In addition to this, investors must announce any redemption of their shares at least one year in advance. The objective is to prevent investors from withdrawing large sums of money within in a short period of time in crisis situations, causing the fund to run into difficulty. The KAGB also stipulates that the average amount of outside capital which funds may borrow from banks to finance their real estate properties may not exceed 30%. Prior to this, this figure was 50%. This has further limited the credit risk associated with open-end funds.

Open-end funds deliver low returns

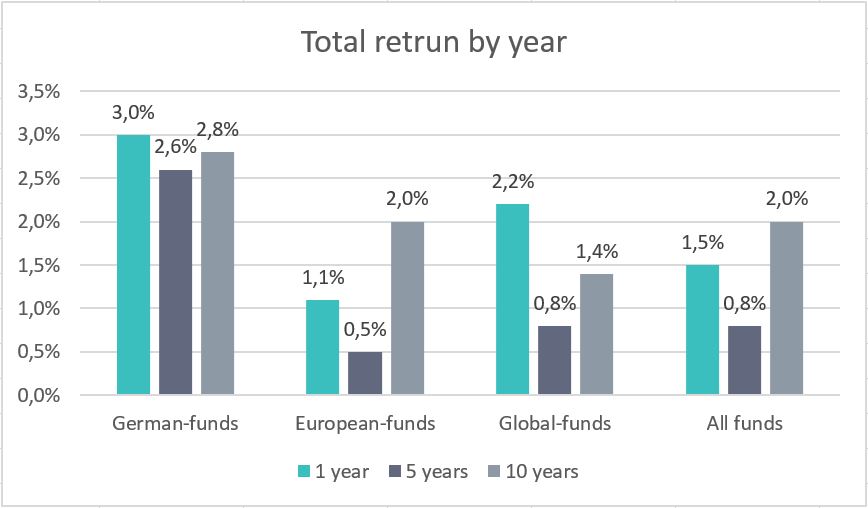

Source: IPD Offene Fonds Immobilien Index (OFIX)

Open-end real estate fund returns tend to be poor. The average return in 2015 was a mere 1.5%. In the five-year period 2011 to 2015 investors received the even lower return of 0.8% per year on their capital. Funds focusing on European real estate have performed particularly badly. German funds have, in comparison, developed well; the returns they offer do not, however, exceed 3%.

Advantages of open-end real estate funds

- Wide distribution of risk – Open-end real estate funds have a large number of varied properties in different regions. This minimizes the risk for the investor should one of the properties run into financial difficulties.

- Low level of borrowing – the amount which fund managers may borrow to finance fund properties may not exceed a maximum sum equivalent to 30% of the market value.

- Security – Management of real estate assets is separate from management of the provider’s assets. As a result, in the event that the fund becomes insolvent investor capital is protected from creditors.

Disadvantages of open-end real estate funds

- Low returns – The annual return for a period of five years is a mere 0.8%.

- High fees – In general, an initial issuing premium of 5% is payable, while an annual management fee of 0.3 % to 3% is charged during the holding period. The overall cost ratio for open-end real estate funds is around 0.7%.

Closed-end real estate funds

Closed-end real estate funds are a well-known form of real estate holding. Closed-end real estate funds must invest in a least three properties. They may only take out loans equivalent to, at most, 60% of the properties’ market value. Prior to 2013 closed-end funds were considered to belong to the grey capital market since they were subject to very little regulation. This changed when the German Capital Investment Act (KAGB) was passed. In consequence, the market was shaken out and consolidated.

Many smaller fund initiators were forced to abandon their activities as they were unable to meet statutory requirements. Investors should be aware that real estate holdings via a closed-end real estate fund represent entrepreneurial holdings which can be subject to a total loss. The reason for this is that, should the fund run into difficulty, the investors are liable for losses up to the sum of their contribution. 5-figure minimum investment sums are the norm for this type of real estate investment; further proof that it is only suitable for experienced private investors.

Catastrophic performance

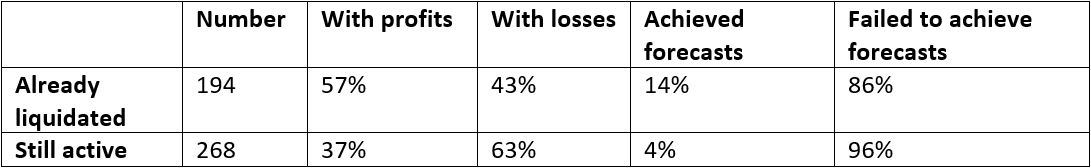

German consumer association Stiftung Warentest examined 194 closed-end real estate funds which had already been liquidated and 268 closed-end real estate funds which were still active. The bitter reality was that only 57% of liquidated and a mere 37% of active funds had achieved profits for their investors. Only a small percentage of funds achieved the high forecast returns offered to investors.

Source: Stiftung Warentest

Advantages of closed-end real estate funds

- High returns – Investors who make good choices can achieve high returns.

- Tax savings – Returns generated by real estate funds with properties abroad are subject to tax in the relevant country, whose rates are usually lower, and also exempt from tax in Germany under the terms of the corresponding double-taxation treaty.

Disadvantages of closed-end real estate funds

- Risk of a total loss

- Unsuitable for inexperienced investors

- High fees – The so-called ‘soft costs’ are around 8% to 11% and include marketing expenses, premiums or costs for brochures.

Real estate shareholdings

Another option in addition to real estate funds is to invest in real estate stock companies (German AGs) which trade on the stock market. Since German private investors are often wary of investing in shares, real estate shareholdings have to date found it difficult to gain ground over other forms of real estate holdings in Germany. The inclusion of residential real estate stock company Vonovia in the DAX 30 has done little to change this.

Good development in recent times

In comparison to the DAX, the development of real estate shareholdings over the last five years has been very good. While the German lead index has only increased by 105%, the E&G German Real Estate Share Index (DIMAX) has gained 158%. It is, however, questionable whether the index has further potential. Many real estate shares are currently listed in line with their net asset value (NAV). As a result, they are traded on the stock exchange at a higher price than the properties in their portfolio are actually worth.

Advantages of real estate shareholdings

- Small sums can be invested

- Shares can be sold on the stock market at any time

Disadvantages of real estate shareholdings

- Share values depends on general stock market conditions

- Purchases and sales are subject to fees

Conclusion

The various types of real estate holding offer differing opportunities and risks. Correspondingly, the returns which can be achieved also vary. In the past investors have had, in some cases, bitter experience with open- and closed-end real estate funds, incurring high losses. Fees are often high, also a negative aspect which has an adverse impact on returns. The still young real estate crowdfunding segment offers attractive interest rates and there are no fees for investors. Investors who pay careful attention to ensuring that properties are in a good location when selecting projects, are well on their way to creating a successful real estate holding.