Study: High returns on Berlin’s housing market

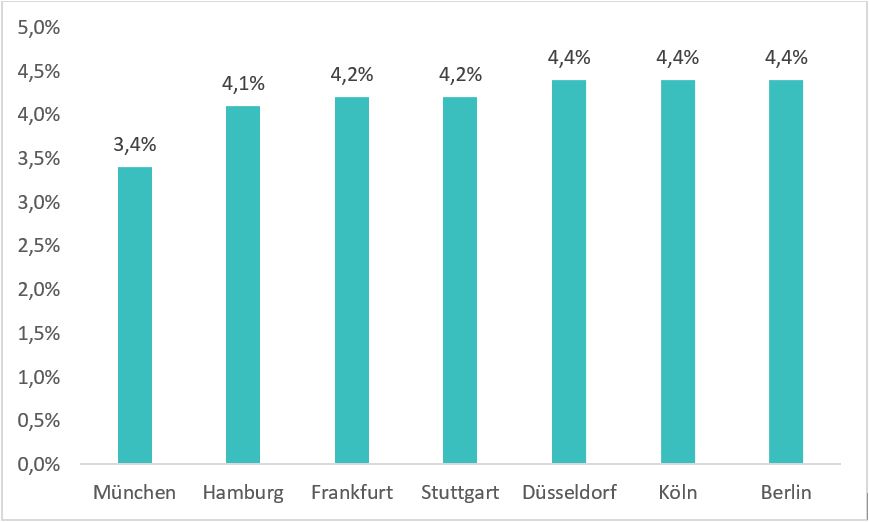

4.4% – Berlin, Dusseldorf and Cologne have the highest return among the seven major real estate strongholds of Germany. This is apparent from a recent study by the real estate consultant Catella.

What does the return indicate?

The current rents are divided by the purchase price of the residential properties in each city. With continued price increases the yield thus decreases. In Munich the return is at only 3.4% due to greatly increased prices. Berlin’s return of 4.4% also shows that the city still has a lot potential with real estate prices.

Berlin, Dusseldorf and Cologne with the highest gross return

Source: Catella Research 2016

Even rents still have a lot of potential

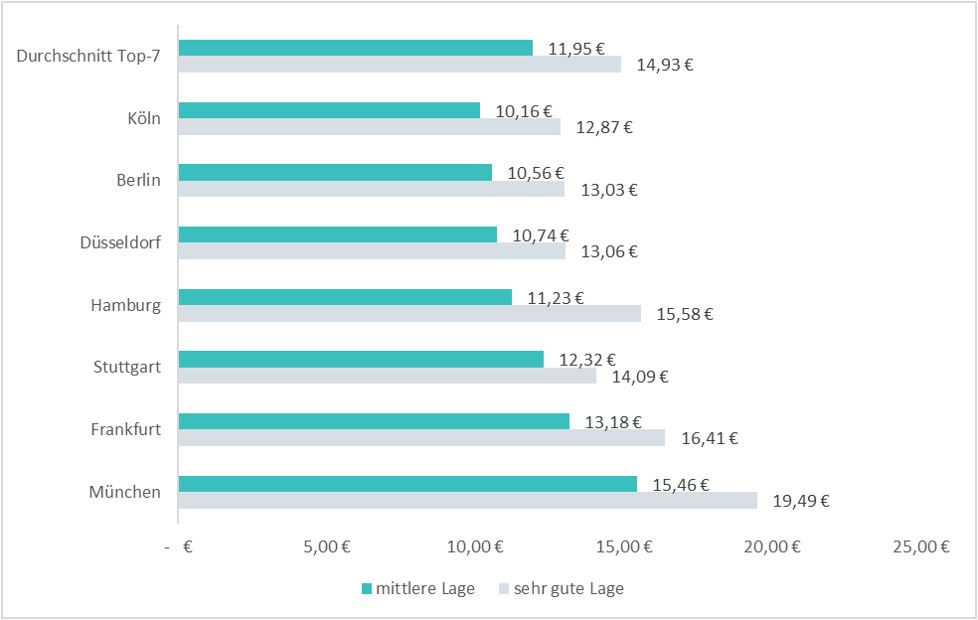

Berlin has the second lowest rents among the top 7 cities in Germany. Only in Cologne are rents in medium and very good location slightly lower on average. Berlin is thus also well below the average for the real estate strongholds. The rents in Berlin thus still have much room for improvement: Between the front runner Munich with 15.46 euros and Berlin with 10.56 euros for medium location, the difference is still at least 5.10 euros.

Rental rates per square meter in medium to very good locations

Source: Catella Research 2016

Conclusion

For Investors Berlin remains a very attractive market: Real estate prices and rents have continued strong growth potential. Furthermore, there are of course many more facts why Berlin is an attractive market. No wonder Crowd investors have already invested 7.4 million euros in Berlin’s real estate. If you want to participate in Berlin’s residential real estate market, you can find out about our current Berlin projects and start investing from as little as 500 euros.